Taxable Income Bracket 2025. How much you owe depends on your annual taxable income. The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

For tax years 2025 and 2025, there are seven federal tax brackets. But some of your income will be taxed in lower tax brackets:

세 종류의 각 소득에 대한 택스는?, For tax year 2025, or the taxes you file in april 2025, these are the tax brackets and income thresholds for the various filing statuses: You’ll pay a tax rate of 0%, 15% or 20% on gains from the sale of most assets or investments held for.

Oct 19 Irs Here Are The New Tax Brackets For 2025 Free Nude, Find out how to calculate your taxable. Each year, the irs publishes the range of income for each tax bracket.

10+ Calculate Tax Return 2025 For You 2025 VJK, A tax rate is the actual percentage you’re taxed based on your income. But some of your income will be taxed in lower tax brackets:

2025 Tax Brackets Chart Printable Forms Free Online, Page last reviewed or updated: Your taxable income and filing status determine which tax brackets.

What is Taxable Explanation, Importance, Calculation Bizness, For 2025, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more qualifying children—it. If you have $11,800 in taxable income in 2025, the first $11,600 is subject to the 10% rate and the remaining $200 is subject to the tax rate of the next bracket (12%).

Here's a look at what the new tax brackets mean for every type, These rates apply to your taxable income. The table below shows the tax brackets for the federal income tax, and it reflects the rates for.

Capital Gains vs. Ordinary The Differences + 3 Tax Planning, Most income is taxed using these seven tax brackets, except for certain capital gains and dividends. A tax rate is the actual percentage you’re taxed based on your income.

Irs Tax Brackets 2025 Chart Printable Forms Free Online, Based on your annual taxable income and filing status, your tax bracket determines your. For 2025, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more qualifying children—it.

[Solved] Using Table 3.7, calculate the combined f SolutionInn, Page last reviewed or updated: 24.42 cents for each $1 over $4,890.

![[Solved] Using Table 3.7, calculate the combined f SolutionInn](https://s3.amazonaws.com/si.question.images/image/images15/1351-B-A-A-A-M(36).png)

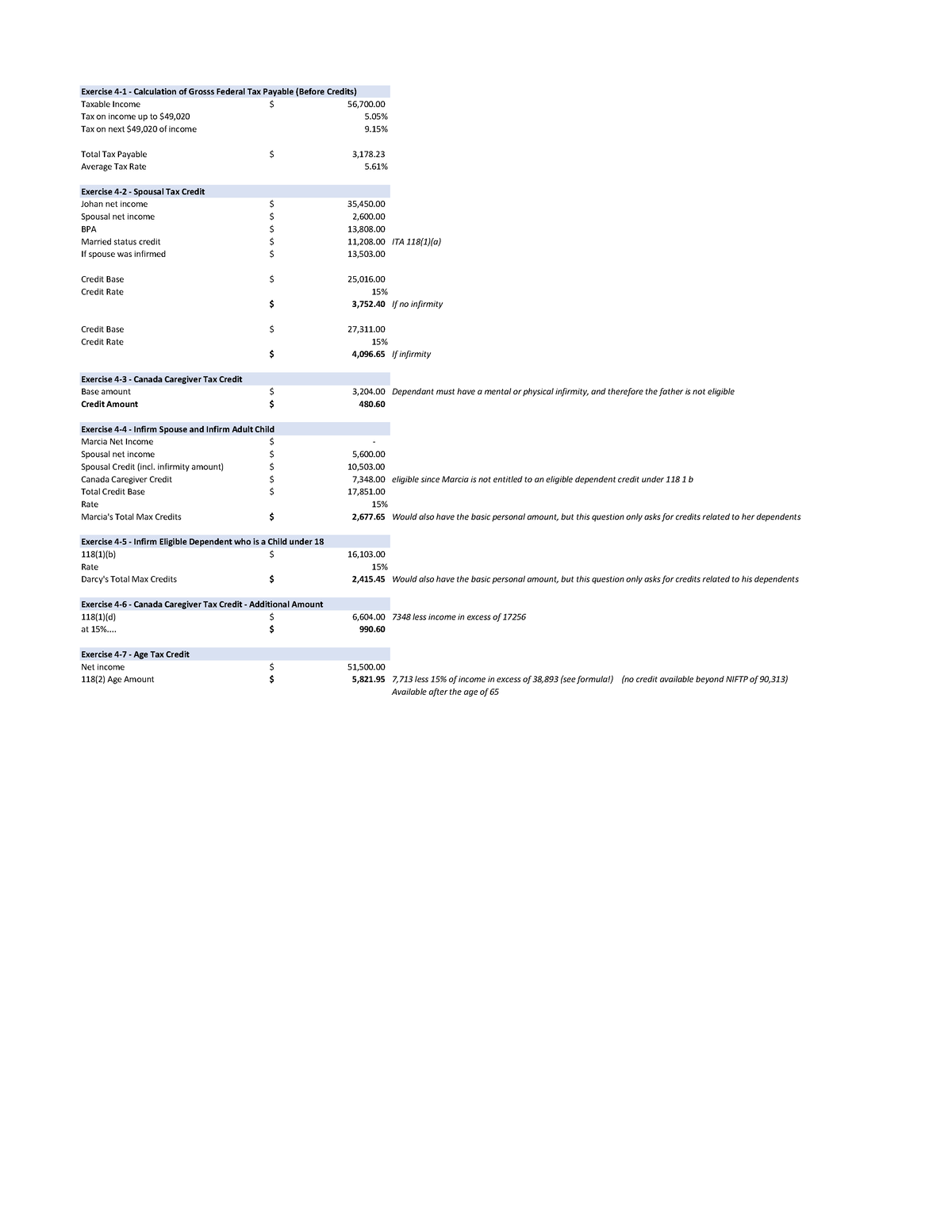

Chapter 4 Exercise Answers Taxable and tax payable for an, If you have $11,800 in taxable income in 2025, the first $11,600 is subject to the 10% rate and the remaining $200 is subject to the tax rate of the next bracket (12%). These rates apply to your taxable income.