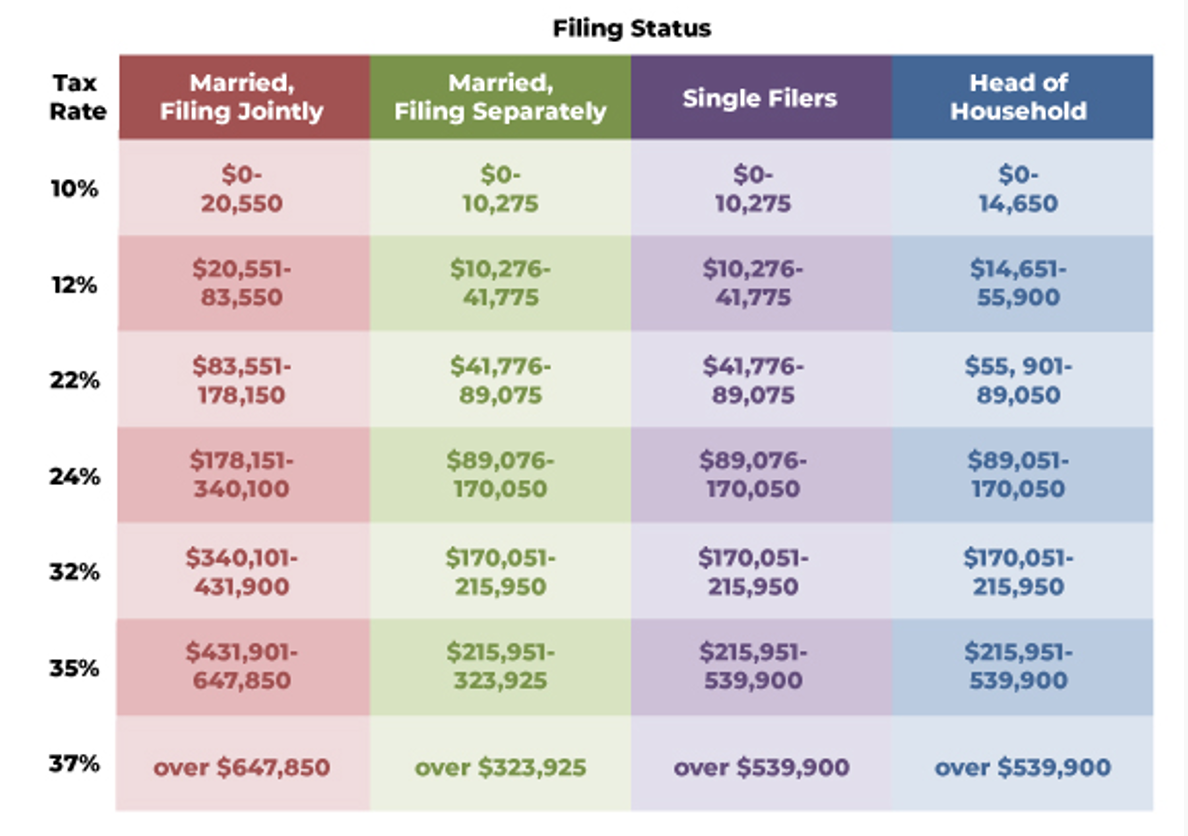

2025 Tax Brackets Head Of Household. The 2025 federal income tax brackets feature seven tax rates ranging from 10% to 37%. Credits, deductions and income reported on other forms or schedules.

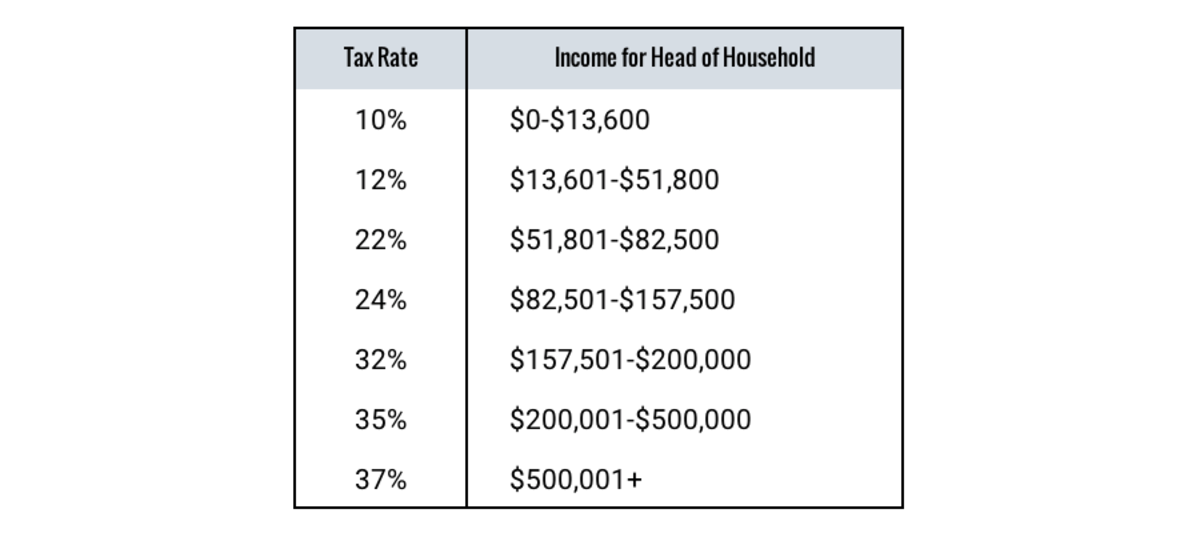

What are the tax brackets for the head of household filing status? The 2025 standard deduction amounts are as follows:

2025 Tax Brackets Single Head Of Household Inez Madeline, 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets: Single, married filing jointly or qualifying widow (er), married filing separately and head of.

Tax Bracket For Head Of Household 2025 Mandy Rozelle, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. You pay tax as a percentage of your income in layers called tax brackets.

Irs 2025 Tables Bria Marlyn, To figure out your tax bracket, first look at the rates for the filing status you plan to use: Compare your take home after tax an.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, Tax filers will need the 2025 federal income tax brackets when they file taxes in 2025. 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

Federal Tax Brackets 2025 Chart Bree Marieann, The 2025 federal income tax brackets feature seven tax rates ranging from 10% to 37%. In 2025 and 2025, there are seven federal income tax rates and brackets:

Compare 2025 Tax Brackets With Previous Years Mela Stormi, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The 2025 standard deduction amounts are as follows:

IRS 2025 Tax Brackets Internal Revenue Code Simplified, There are seven federal tax brackets for tax year 2025. An increase in government expenditure, and a small cut in income taxes:

Tax Brackets 2025 Explained Ny Joete Madelin, Your tax bracket depends on your taxable income and your filing status: In 2025 and 2025, there are seven federal income tax rates and brackets:

2025 Tax Brackets Head Of Household Tim Maridel, Tax filers will need the 2025 federal income tax brackets when they file taxes in 2025. Your tax bracket depends on your taxable income and your filing status:

2025 Tax Medical Deductions Flore Jillana, The federal income tax has seven tax rates in 2025: For head of household taxpayers, from.